MUMBAI: Tata Power plans to bid for two

electricity distribution companies in Uttar Pradesh —Dakshinanchal Vidyut Vitran Nigam and Purvanchal Vidyut Vitran Nigam—once tender documents are released, said MD Praveer Sinha.

This move supports Tata Power’s goal to grow its

transmission and distribution (T&D) business, which brings in most of its revenue and a large share of its profits.

“Based on our discussions, bid documents are being finalized and are expected by the end of the month. They (UP) are looking to privatise two discoms— Dakshinanchal and Purvanchal —which will be divided into six circles. We will participate actively when the documents are available,” Sinha said.

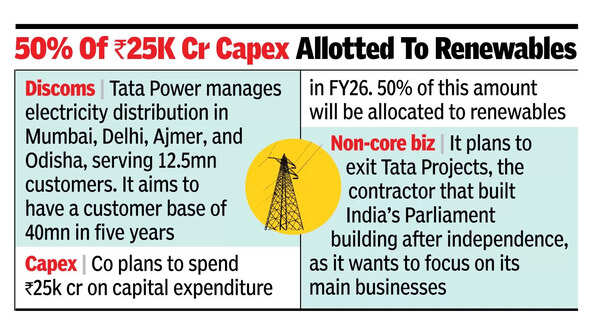

Capex alloted to renewable

Currently, Tata Power handles electricity supply in Mumbai, Delhi, Ajmer, and Odisha, serving 12.5 million customers. It aims to expand its customer base to 40 million within the next five years.

UP has five discoms, and the government seeks private sector involvement in two—Dakshinanchal and Purvanchal. The state's goal is to cut losses and enhance efficiency in these discoms. Most likely, the government will choose a

public-private partnership, with private companies holding a majority stake.

Dakshinanchal and Purvanchal service 42 of UP’s 75 districts.

Tata Power has improved the financial health of the discoms after it checked into them, which also positions it to capitalise on opportunities arising in the power distribution space. For instance, the profit of Odisha discom, in which it holds 51% and the Odisha government owns 49%, increased by 86%, reaching Rs 439 crore in FY25 from Rs 236 crore in FY22. Odisha discom came under Tata Power’s management between June 2020 and April 2021.

Regarding nuclear energy, Tata Power awaits government regulations before it enters the

small modular nuclear reactor business. “We are awaiting amendments to the Nuclear Power Act—specifically civil liability and private sector participation. We expect the amendments to be discussed during the monsoon session. We are preparing with site evaluations, water arrangements, and technology reviews, but our next step depends on legal clarity,” Sinha said. Tata Power’s sister companies, Tata Steel and Tata Motors, are potential customers for its nuclear energy offerings.

The utility company plans to spend Rs 25,000 crore on capital expenditure in FY26. Sinha said 50% of this amount will be allocated to renewables, 30% to T&D and 20% to generation (including pumped hydro). In FY25, it spent Rs 16,000 crore on capex, falling short of the Rs 20,000 crore target. The reduced spending was attributed to delays in transmission and renewable projects, according to the leadership.

Tata Power plans to exit Tata Projects, best known as the contractor that built India’s first parliament building after independence, as it wants to focus on its main businesses. It did not buy new shares of Tata Projects during the recent rights issue, lowering its stake to 23% from 31%. Tata Sons owns more than half of Tata Projects, with Tata Chemicals holding a smaller stake. “Tata Power is focused on growth in core businesses: renewables, hydro and T&D.We need capital for this, so we have chosen not to allocate funds to non-core ventures,” said Sinha, who is also the chairman of Tata Projects. “We have been divesting non-core and overseas assets and will continue to do so,” he added.